Best Loan Apps

Exploring the Best Loan Apps in India Without Income Proof

“The loan apps help people meet their financial demands by giving them easy and rapid access to personal loans. These applications are now the go-to alternative for people in need of emergency money because they require little documentation, offer flexible repayment plans, and provide quick approval. These apps provide easy, transparent services with different interest rates and processing costs, regardless of the size of the loan you are searching for.

In today’s date, there are more than 5000 apps in India that give you instant loans. But there are very few apps that are

best loan apps in india and give you loans without income proof. In this blog, we will talk about those apps that don’t require income proof.

The Importance of Choosing RBI-Approved Loan Apps

Now, we do not recommend you take any kind of instant loan. But we understand that sometimes situations arise, emergencies happen, where you need money and are forced to take a loan. In such cases, you should only take loans from companies that are RBI-approved, and it is very important to know the loan terms and conditions. But don’t worry, in this blog, we will tell you everything.

- In the list we have two best loan apps rbi approved and these are

KreditBee is a licensed NBFC (Non-Banking Financial Company) registered with the RBI

- MoneyTap is also an RBI-approved lender and operates under the NBFC category.

Now, the category of best loan apps without income proof can be divided into two categories. The first category is where you don’t need income, and you can get a loan without income.

That is best loan apps for students. The second category is where you need income, but you don’t need to upload income proof. In this blog, we will analyze both categories. We will be comparing seven apps on eight different parameters: maximum loan amount, eligibility, interest rate, tenure, processing fees, disbursement time, late fees, and ratings.

First, we will talk about the maximum loan amount. In simple words, how much loan you can get from these apps. We will discuss this parameter first, along with the loan tenure. As you can see, the highest loan amount can be obtained from Navi, followed by others.

AirtelXstream.in is a student-focused app, this is the

best loan apps without income proof, where you can get a loan without any income. The other five apps mentioned above require income sources, but you don’t need to upload income proof like a salary slip.

Now, talking about eligibility criteria, as we mentioned, M-Pocket and Pocketly are student-focused apps where you can get a loan without income proof. In fact, you don’t even need income; you can get a loan just like that. But it’s important to note that if you are over 22 or 23 years old, you will need to show some kind of income proof.

If your age is over 21, you can use apps like Navi, LezPay, M-Pocket, and others.

You might get a higher interest rate, but you will still get an offer. In Navi, your CIBIL score should be 750 or above. Honestly, Navi is for customers who need an instant loan, or those who can get a loan from a normal bank as well.

If we talk about minimum monthly salary, AirtelBank.com also offers loans.

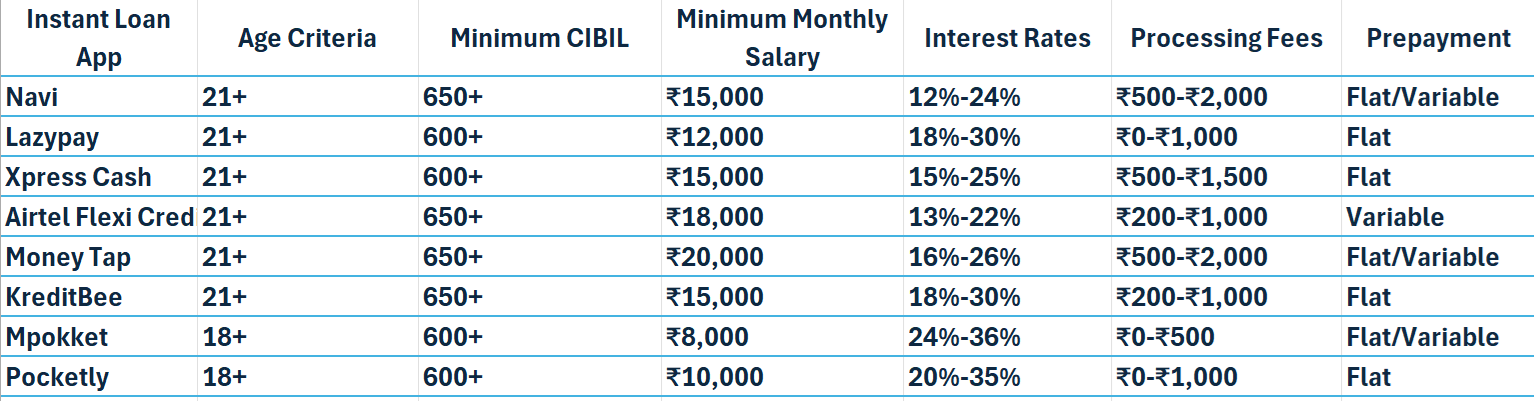

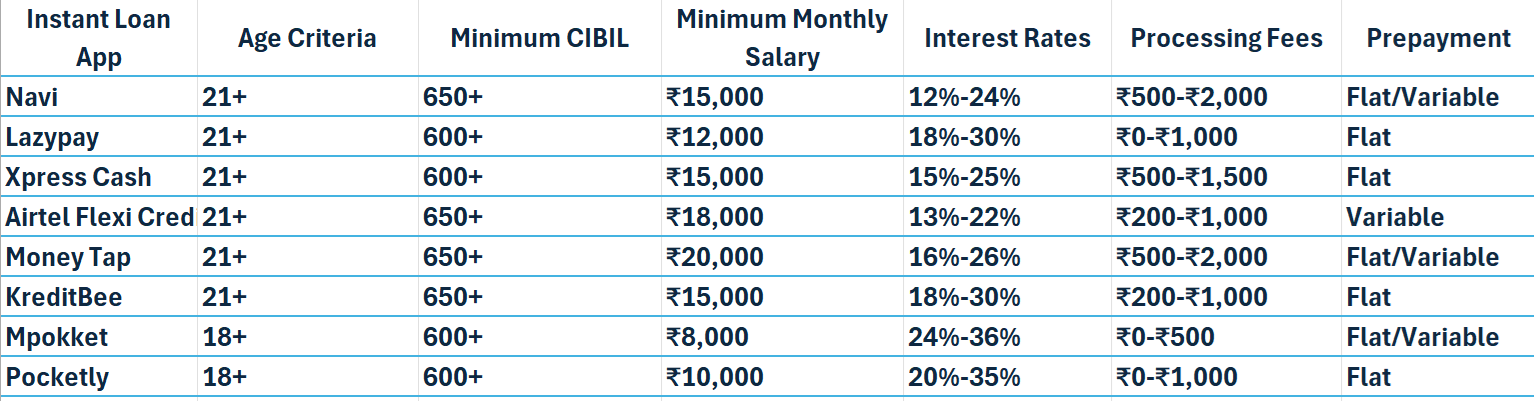

Here’s a table with the loan apps you provided, along with the details for age criteria, minimum CIBIL score, and minimum monthly salary. Please note that the exact information may vary, so it’s always best to verify with the official app details.

Instant Loan App Age Criteria Minimum CIBIL Score Minimum Monthly Salary

As you can see, we have listed the interest rate ranges for all the apps here. Now, the thing is, most of these apps don’t provide complete clarity on their interest rates, making it a bit tough to get an idea of how much interest they charge. Still, if we compare overall, M-Pocket and Pocketly charge the highest because both these apps are technically giving loans to students who don’t have any credit score or income source and these are

best loan apps without credit score for your short term need as a student.

Lazypay, Mpokket & Pocketly offers the lowest processing fee, with ₹0 for some loans. In contrast, Navi, XpressCash, and Money Tap charge higher fees, ranging from ₹500 to ₹2,000 depending on the loan amount.

Talking about prepayment, the same scenario applies: some have a flat charge, while others have a variable one.

Now, which app is right for you will depend on your loan amount. Still, let’s try to explain this with an example.

Let’s say you took a loan of 50,000 for six months, and you repay the loan amount one month earlier. In this case, let’s see what charges apply.

The highest processing fee will be charged by Navi and Moneytap

Now, let’s see how to apply for loans in these companies and how quickly you will get the loan.

Well, the process is online for all of them, and the loan amount will also be credited to your bank account online. Some apps like Navi, LazyPay, M-Pocket offer loans within minutes, while others like Airtel Flexi and MoneyTab may take one to two days. Honestly, how quickly you get the loan depends on your CIBIL score, whether your documents are correct, and if you’ve ever defaulted. The simpler your case, the faster you will get the loan.

I would like to mention that all the information we’ve provided here has been researched by our team so that you can get the best and latest information without wasting time.

If you found this blog helpful, and if you want to validate our efforts, please leave a comment saying that this is the best information on instant loan apps. It will make our hard work successful.

Finally, let’s look at customer support for these companies, just to conclude.

What happens is, in many of these instant loan companies, you might get some unfair charges, so good customer support is essential. You should prefer a company that provides both phone and email support. As you can see, there are three companies—MoneyTab, M-Pocket, and Pocketly—that only provide email support, while the rest provide support via phone or chat as well.

As you can see, picking the best instant loan app is a bit tricky. It depends on everyone’s needs, and for each customer, the answer can be different. So, based on your loan amount and requirements, you can decide which app is best for you. Our job was to bring all the information to you. We’ve presented detailed information about all the apps. As you can see, a lot of effort goes into making the blog and presenting the information.

So, if you liked this post and found the information useful, don’t forget to subscribe and share this information as well.

watch this……Portable Smart Electric Shoe Dryer |Boot Heater and Dehumidifier Machine

Also read this…daily tarotscope-Unlock the secrets of your day

Recent Comments